Investing.com– Asian stocks rose on Monday, with Japanese stocks leading gains as strong U.S. payrolls data quashed concerns over an economic slowdown, while hopes of more stimulus measures in China also aided sentiment.

Regional stocks took positive cues from a Friday rally on Wall Street, which came in the wake of a substantially stronger-than-expected nonfarm payrolls reading. The data dispelled concerns over a U.S. recession, but also dented bets on a sharp reduction in interest rates.

U.S. stock index futures rose slightly in Asian trade.

Asian trading volumes were somewhat limited by the Golden Week holiday in China. But Chinese markets are set to rise sharply when trade resumes on Tuesday, amid persistent cheer over more stimulus measures in the country.

Japanese stocks lead gains as yen declines

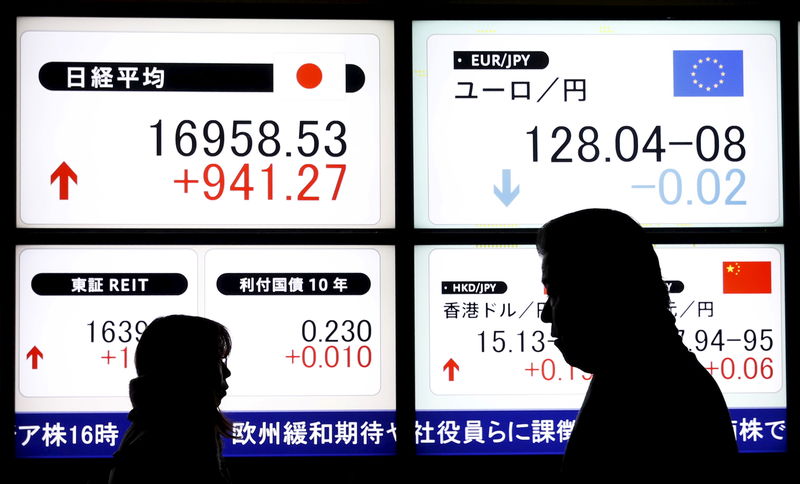

Japan’s Nikkei 225 and TOPIX indexes were the best performers in Asia on Monday, rallying between 1.8% and 2%. Gains in Japanese markets also tracked weakness in the Japanese yen, amid growing doubts over the Bank of Japan’s ability to raise interest rates further.

7-Eleven owner Seven & i Holdings Co., Ltd. (TYO:3382) surged over 3% after reports said the firm was planning to sell a stake in its supermarket unit, ahead of a widely anticipated listing.

Separately, reports said that Canada’s Alimentation Couche Tard Inc (TSX:ATD) had received backing from Quebec’s public pension fund to pursue a takeover bid for Seven & i, after the latter rejected an initial offer.

Hong Kong stocks up, China stimulus in focus

Hong Kong’s Hang Seng index added 0.6%, extending a run of recent gains as optimism over more Chinese stimulus drew investors back into heavily-discounted mainland stocks.

Mainland Chinese markets are set to reopen on Tuesday after the Golden Week holiday, and are likely to see strong gains.

China’s top economic planner is set to hold a briefing on Tuesday outlining more stimulus support for the country, after a series of strong measures in late-September.

These measures had sparked strong gains in the Shanghai Shenzhen CSI 300 and Shanghai Composite indexes, enabling them to recover from near eight-month lows.

Optimism over China buoyed broader Asian markets. South Korea’s KOSPI added 0.8%, while Australia’s ASX 200 rose 0.5%.

Futures for India’s Nifty 50 index pointed to a muted open, after the index plummeted from record highs hit in September.

Beyond China, focus this week is on a string of addresses by U.S. Federal Reserve officials, as well as consumer inflation data from the world’s biggest economy. Traders were seen pricing out expectations for another 50 basis point rate cut by the Fed in November, CME Fedwatch showed.