By Leika Kihara

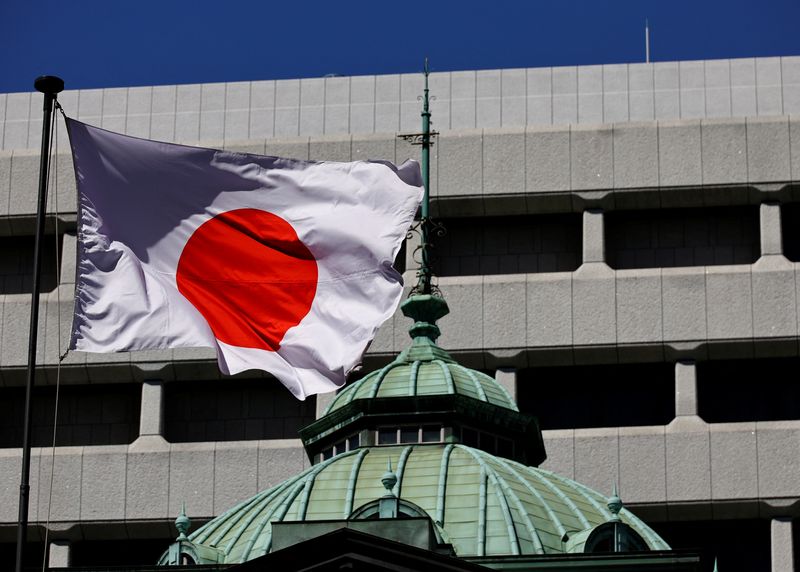

TOKYO (Reuters) -Bank of Japan policymakers were divided on how soon they could raise interest rates with some warning of the risk of renewed market volatility, a summary of opinions at the October policy meeting showed on Monday (NASDAQ:MNDY).

Many in the nine-member board highlighted the need to scrutinise market developments, particularly yen moves, in determining whether Japan’s economy can weather higher borrowing costs, the summary showed.

While the risk of a U.S. hard landing has subsided, the BOJ must spend time scrutinising market developments “as it was too early to conclude markets will restore calm,” one member said.

Another member said the BOJ must “take time and exercise caution” when raising rates.

Others, however, saw the need to communicate clearly the BOJ’s resolve to continue raising rates if its economic and price forecasts are met, the summary showed.

“The Bank should consider further rate hikes after pausing to assess developments in the U.S. economy,” one member was quoted as saying, adding that Japan’s economy no longer needed substantial monetary support.

At the Oct. 30-31 meeting, the BOJ maintained ultra-low interest rates but said risks around the U.S. economy were somewhat subsiding, signalling that conditions are falling into place to raise interest rates again.